In today’s fast-paced world, getting a quick financial boost can be as crucial as a cup of coffee in the morning. Enter the “cup loan application” – a concept that’s brewing interest and curiosity across the globe. Whether you’re a caffeine aficionado looking to open your own coffee shop or simply in need of an expedited financial solution, understanding the intricacies of a cup loan application can set you on the path to success. So, let’s dive in, sip by sip, into this detailed guide, ensuring you’re fully equipped to navigate the process smoothly.

What’s Brewing in the World of Cup Loans?

Cup loans offer a unique blend of convenience and efficiency in the financial sector. They’re designed for quick disbursements, minimal paperwork, and are as straightforward as ordering your favorite coffee. But how do you ensure your application doesn’t just sit on the counter? Let’s spill the beans.

Steaming Through the Application Process

Navigating the cup loan application process need not be as complex as it sounds. Here’s a step-by-step guide to make sure you’re on the right track:

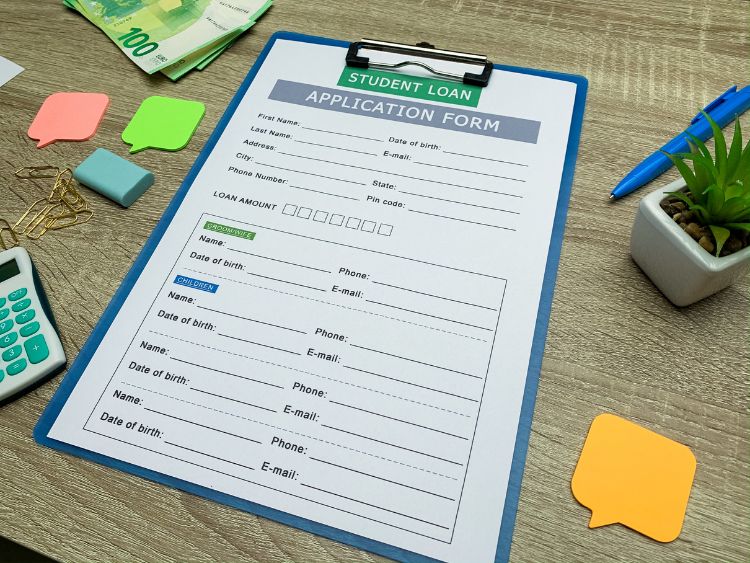

- Preparation is Key: Just as you wouldn’t brew a cup without grinding your beans, don’t start your application without the necessary documents. Gather your financial statements, identification documents, and any other required paperwork.

- Know Your Blend: Understanding the type of loan that suits your needs is crucial. Are you looking for a short-term espresso shot or a long-term, slow-brewed drip coffee? Clarify your objectives and research accordingly.

- Application Brew-time: Filling out your application is the brewing process. Ensure every detail is accurate to avoid any bitterness later. Online platforms often provide a seamless, user-friendly interface for this step.

- Await the Pour: Once submitted, there’s a brief waiting period – the steep time, if you will. Use this to prepare for potential interviews or additional requirements.

- Tasting the Success: Approval is the first sip of your freshly brewed success. It’s vital, however, to understand the repayment terms to ensure the aftertaste remains pleasant.

Percolating Through the Terms and Conditions

Understanding the terms of your cup loan is like knowing the origin of your coffee beans – it’s crucial for the perfect cup. Interest rates, repayment periods, and any hidden fees should be clear from the get-go. Always ask questions if anything seems murky.

FAQs: Demystifying the Cup Loan Brew

- What’s the difference between a cup loan and a traditional loan? Cup loans are typically quicker to obtain, with less paperwork and faster approval times. They’re perfect for those needing a rapid financial infusion.

- Can I apply for a cup loan with bad credit? Yes, but like a strong cup of coffee, expect conditions to be a bit more intense. Higher interest rates or additional security might be required.

- How quickly can I expect to receive the loan? Just as your espresso takes minutes, some cup loan applications boast same-day processing. However, this can vary based on the lender.

Pouring Over the Importance of a Solid Repayment Plan

Let’s not forget the importance of a solid repayment plan. It’s the coaster under your cup; it protects you from potential stains on your financial stability. Plan your finances to ensure timely repayments and maintain a good credit score.

Summary: The Last Drop

Navigating the world of cup loan applications doesn’t have to be daunting. With the right preparation, understanding, and approach, you can streamline the process, ensuring a quick and favorable outcome. Remember, like a good cup of coffee, the key to a successful cup loan application lies in the details and the preparation. So, take that first sip confidently, knowing you’re well-informed and ready to embark on your financial journey.